So Long, Soft Landing...

In this week's MIM, we are diving into fake crypto data, takeaways from Jackson Hole, Europe's energy crisis, China's fresh lockdown & more.

Good morning MIMs,

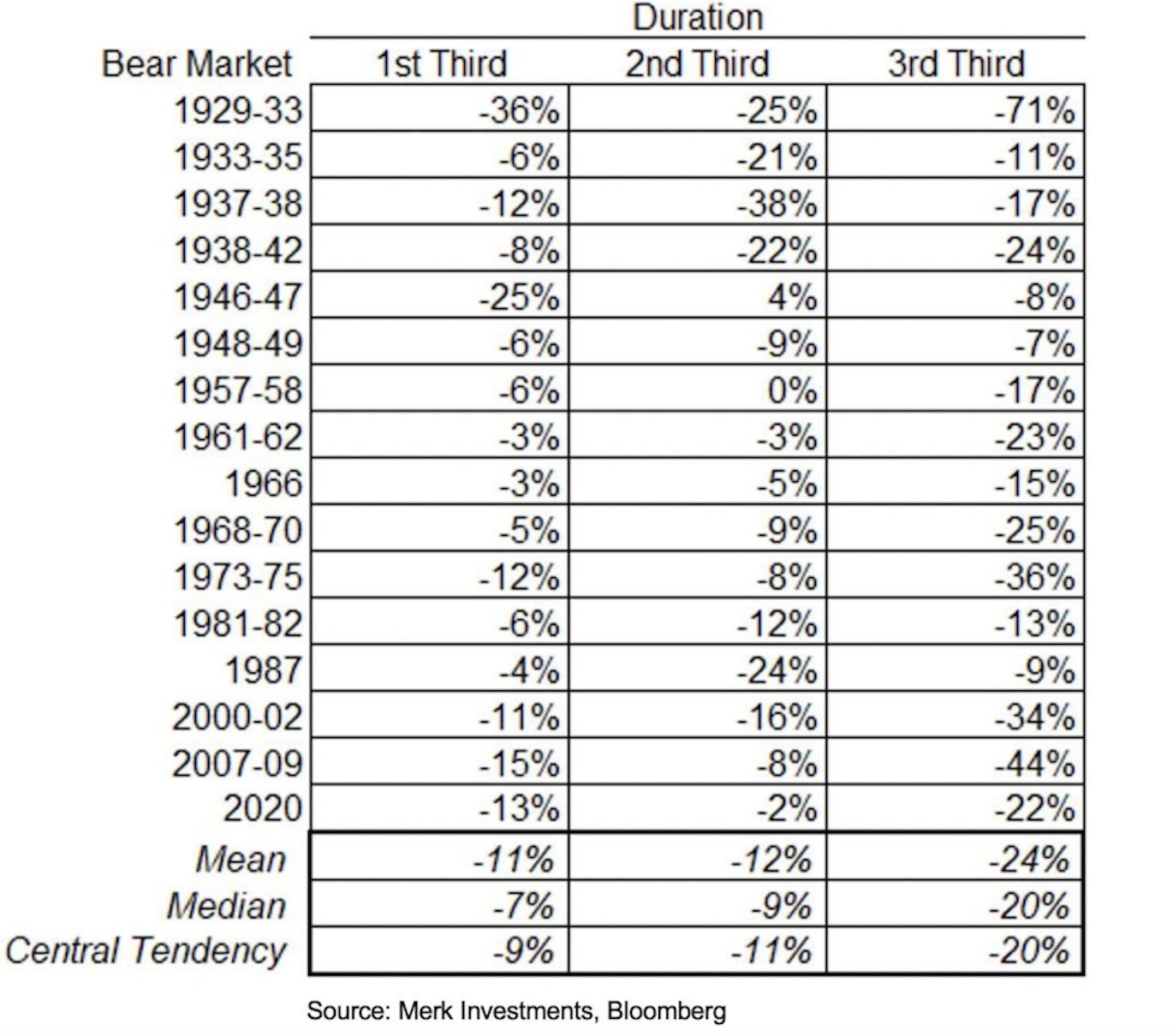

Before we get into this week’s issue, here’s a this-time-not-so-comforting reminder that bear markets tend to end with a bang. In fact, the last third of the crash typically brings losses twice as big as those during the first two thirds.

Here’s a handy table:

(H/T to Nick Reece)

🚀 Digital Assets

The “La La La Land” of Crypto Data

Crypto numbers you see every day aren’t as real as you might think.

There have long been concerns over the accuracy of crypto data due to lack of standardized reporting and regulation, but there wasn’t that much insight into how bad it is.

Well, until now.

Javier Pax, director of data and analytics at Forbes’ digital assets arm, scrutinized 157 crypto exchanges and found an extreme mismatch between reported and actual bitcoin trading data.

Long story short, his analysis estimated that over half of all bitcoin trades are either wash trading or just fake:

“More than half of all reported trading volume is likely to be fake or non-economic. Forbes estimates the global daily bitcoin volume for the industry was $128 billion on June 14. That is 51% less than the $262 billion one would get by taking the sum of self-reported volume from multiple sources.”

What’s happening here?

🔍 Zooming out

There are two culprits to blame for this stark discrepancy in crypto data.

First and most obvious, unregulated exchanges that are straight up faking trading volume data.

That has to do with the fact that many crypto websites rank exchanges based on sheer trading volume. So, sprucing up volume figures here and there is a tempting shortcut that can instantly give them more visibility and bring in more customers.

This malpractice came into the spotlight in 2019 when Bitwise Asset Management revealed that 95% of trading volumes reported by exchanges on CoinMarketCap—the world’s #1 crypto data website—were fake.

And the smaller the exchange, the more drastic figure massaging typically is.

Pax’s investigation found the biggest data discrepancies were among less-known and smaller exchanges (labeled as “group 3” in the chart below). Their actual volumes turned out, get this, 80-99% lower than reported.

Which means such exchanges are faking nearly all their bitcoin trades.

The second culprit is whale investors who open then immediately close their positions for no economic reason. In industry jargon, it’s called wash trading.

It's an illegal practice that big-pocketed traders exploit to create a false impression of demand and manipulate markets, which can be extremely effective in pump and dump schemes.

🔮 Looking ahead

Pax’s analysis covers just bitcoin. So on one hand, it doesn’t tell us much about the whole crypto market. On the other, it does.

If there‘s so much fake data in such a reputable cryptocurrency, you don’t need much imagination to realize how much of the data is made up in smaller cryptocurrencies; the data that many investors take at face value.

The takeaway?

As long as the crypto market is so unregulated, take all crypto data with a big grain of salt. Because, apparently, the crypto you proudly hold or the exchange you entrusted it with may be as liquid as a rock.

📉 Stocks

So long, Soft Landing

Jackson Hole fears came to pass.

At the annual economic symposium, Fed chief Jerome Powell spoke his mind and, well, to say the least, his thinking hasn’t struck a chord with investors.

After his remarks, stocks had the worst day since June. On Friday, the Dow Jones Industrial Average dropped a crazy 1,000 points, or 3%. The S&P 500 slumped 3.37%, and the tech-heavy Nasdaq slid another 3.94%.

Although slowed, the sell-off carried over well into this week.

🔍 Zooming out

So what in Powell’s words scared the hell out of investors?

Powell made it clear that he won’t change his course just because inflation slacked off for a month or two—contrary to what the markets assumed after July’s positive inflation reading.

“While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the committee will need to see before we are confident that inflation is moving down,” the Fed chief told the audience.

Especially when the labor market is red hot, which in Powell’s eyes is “clearly out of balance” because there’s just too much demand for workers.

He also reiterated that inflation will stay top of mind until it subsides to the 2% target. And that the Fed will do everything in its power to get there with little regard to implications for the economy.

In fact, he explicitly told investors to brace for “pain”:

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” he said.

And to rub even more salt into the wound, Powell hinted at another “unusually higher” rate hike in September.

🔮 Looking ahead

There are two main theories about what Powell is doing here.

One is that Jerome Powell is just being honest and will follow through on his words even if it means a severe recession. That’s, obviously, bad for stocks, which rose over the summer entirely on hopes of a Fed “pivot.”

The other is that Powell may be playing a game of expectations. The reason for dropping forward guidance and not reassuring investors is to pre-empt another speculative run-up in stocks, which would stoke inflation again.

In other words, the whole idea behind his stern hawkish tone may be not so much about taking action as it is about intimidation.

Either way, Jackson Hole is yet another reminder: Don't fight the Fed in a Fed dollars-driven market.

🏛️ Macro

Here’s a quick run-through of what’s roiled the market over the past week.

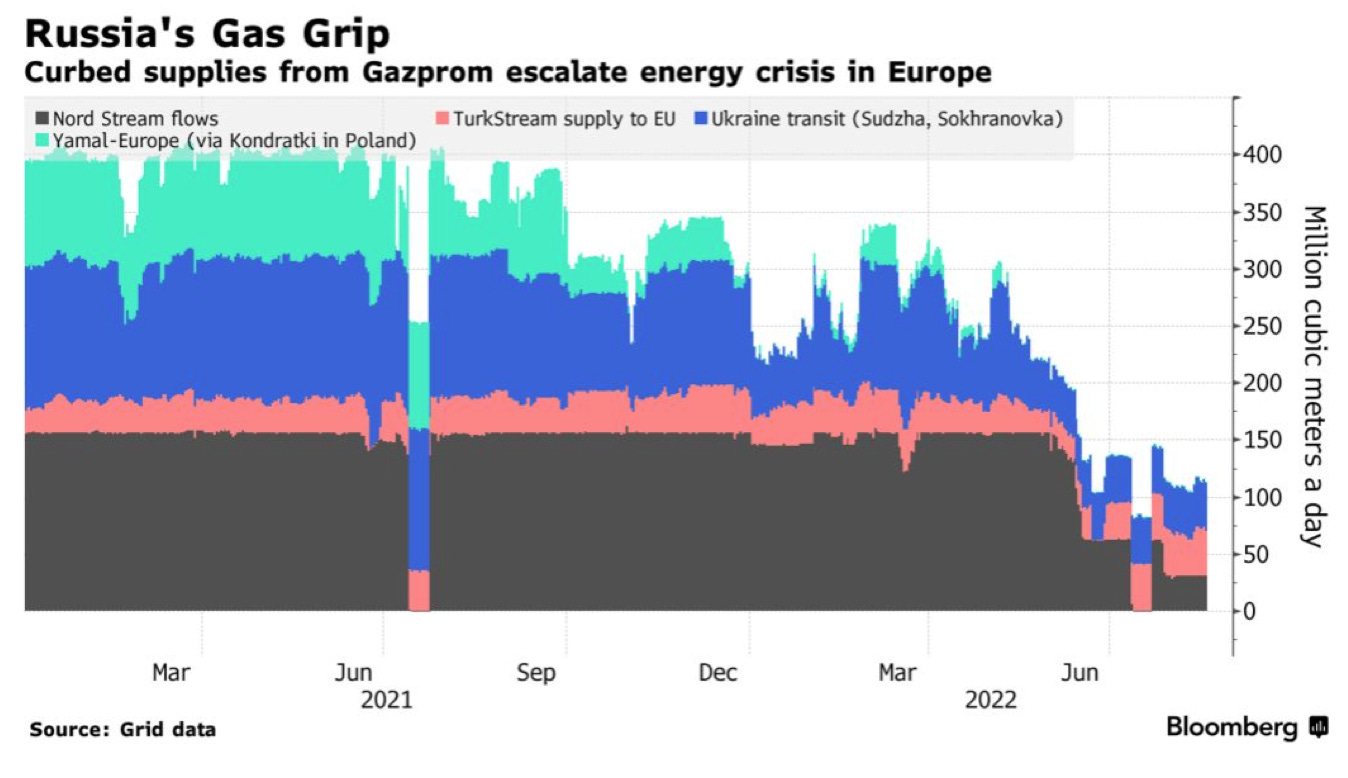

Europe’s energy saga continues. Gazprom, the Kremlin-controlled gas giant that controls Nord Stream, once again halted its gas supply to Europe for three days due to supposed “maintenance.” Since Thursday, it also shut off supply to French utility giant Engie citing payments delays.

These curbs only confirm that Russia will likely take advantage of the cold season to terrorize Europe using the energy card. If so, Europe is in for one of the coldest winters in history. Things could go so bad that the continent may resort to strict rationing, which could lead to a severe recession and social unrest.

Job growth in the U.S. has fallen off the cliff. According to an independent report from ADP, the private sector added just 132,000 jobs in August, a sharp deceleration from 270,000 jobs in July. Economists are flabbergasted because the figure comes to just one-third of what a median forecast in a Bloomberg survey of economists called. What gives? The slowed hiring probably has to do with broader sentiment, which lost its cool after July’s flash of euphoria. “Our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy’s conflicting signals,” wrote ADP’s economist Nela Richardson.

China puts 20 million residents in Chengdu under lockdown in pursuit of its uncompromising “zero COVID” policy. It’s the biggest Chinese city to close since Shanghai, and a major industrial hub that runs assembly lines of the world’s biggest tech companies and automakers, including Apple, Intel, Toyota, and VW.

💬 Quote MIMs Are Pondering

Sticking to the theme we started off this weekly with, here’s an accompanying quote from one of the best hedge fund managers that MIMs are drilling into their heads this week.

“There’s no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it’s end of the bull market or the end of a bear market.” — Paul Tudor Jones, billionaire hedge fund manager

Hang in there!