Masterworks—The Ultra-Wealthy Invested 54% of Their Money in This

In this week's MIM, we dive deep into the surprising explosion of alternative investments, their ubiquitousness in ultra-wealthy portfolios, and how you can use Masterworks tap into that trend...

Morning MIMs,

This week happens to be our first-ever sponsored story, which is a significant milestone for MIM that wouldn’t be possible without your fierce support. So, a big THANK YOU to all of you. And because I promised to keep this newsletter 100% transparent, it calls for something of a manifesto as to how we’ll approach advertising.

The most objective “critic” of next-gen investment products

Now, just because we run ads doesn't mean we’ll spam you with some bogus get-rich-quick schemes, NFT projects, or whoever writes the fattest check. Not at all. In fact, over the past two months, we turned down all requests except this one.

That’s because any company that will appear on MIM has to align with our mission to help people become their own best money managers and pass this five-step screening test:

It follows all laws and regulations that protect investors’ interests and has a strong track record (no “black hat,” Ponzi schemes, or overly speculative products).

It markets its products in a way that builds realistic expectations for their actual utility or potential gains.

It offers something new or really competitive that pushes the envelope of finance. Or, put another way, it has a cool product we would write up in MIM even if we didn’t get paid.

It fits into interesting trends in finance and invites a broader discussion that you will take something away from — even if you aren’t interested in the product itself.

And most important, it lets us keep our independent voice and say about its product whatever we want to say.

My goal here is to make MIM the most objective “critic” of some of the coolest and most promising investment products out there. And from your feedback so far, I feel that MIM has earned enough trust to make this happen.

(If you have any questions about our process, or want us to review any product that caught your eye, drop a message at dan@meanwhileinmarkets.com.)

So without further ado, let’s get into today’s topic.

- Dan, founder and editor

P.S. This is not investment advice.

The Ultra-Wealthy Invested 54% of Their Money in This

If there were a hall of fame for the biggest contributors to democracy, technology would be high on the list.

It's the most significant liberating force that has handed power and access — once only available to a select view —to the masses. It applies to every domain you can think of, and investing is probably the best example.

Consider this.

In 1950, the average American had access to just $12 billion worth of stocks* and one mutual fund. And to buy or sell any stock, they had to call a broker, arrange a trade, pay hefty fees, and wait days for the trade to execute.

(* If you adjust for inflation, that amounts to 5% of what Apple alone is worth today.)

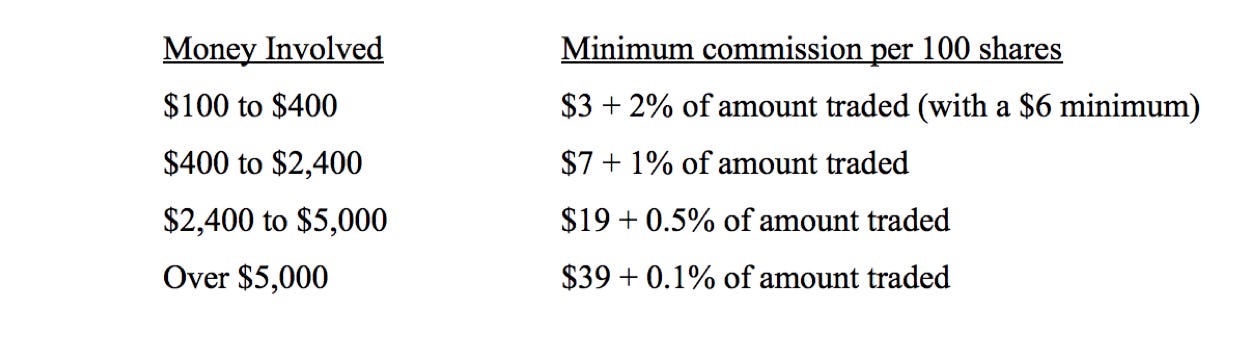

At the time, the New York Stock Exchange worked as a de-facto cartel that fixed a minimum commission for all brokers. Here’s a peek into what a single stock trade cost before the 1975 reform:

For some perspective, if you had to build an S&P 500 ETF-like portfolio by yourself, back then you had to shell out at least $20,000 (+ $6,000 in fees both ways) at the start, and then probably a couple of grand each month for rebalancing.

And forget about anything more “exotic” like derivative instruments, actively-managed ETFs, or simply overseas stocks.

The market was just too expensive, illiquid, and obscure for the average American to build a diversified portfolio. Not surprisingly, in 1952, just over six million Americans owned stocks—at that time just 4.2% of the population.

Today six out of 10 Americans own a portfolio of stocks because technology has made it cheap and simple.

With a few taps on your phone, you can buy an ETF comprised of 1,000+ stocks from all across the world that automatically rebalances itself based on hundreds of strategies of your choice.

Better yet, the automation of brokering cut transaction costs to a minimum and gave rise to commission-free trading. But technology isn't just giving investors a cheaper and better user experience to buy stocks at scale.

Over the past decade, technology has been “securitizing” a number of alternative investments, which gives individual investors a chance to own a slice of investments that not so long ago were reserved only for the wealthy.

That includes all things from simple high capital-intensive investments like real estate and venture capital to more exotic ones like vintage cars, fine wines/spirits, and all sorts of art.

And these alternatives are quickly becoming a core part of the modern portfolio.

Why billionaires invest over half of all their money in alternatives

If you had to cram all of the world’s investment advice into a single rule of thumb, it would come down to just a single word: diversify.

Diversify across companies and sectors. Diversify between asset classes. Even mix up asset managers. All so that a single blow or oversight won’t wipe out your entire retirement savings.

From an asset class perspective, diversifying used to be easy. You simply juggled two asset classes: bonds and stocks. Can afford to take chances? Load up on more stocks. Taking it easy before retirement? Tilt the portfolio toward bonds.

But the traditional stock-bond portfolio, the gold standard of investing, is losing its luster for two main reasons.

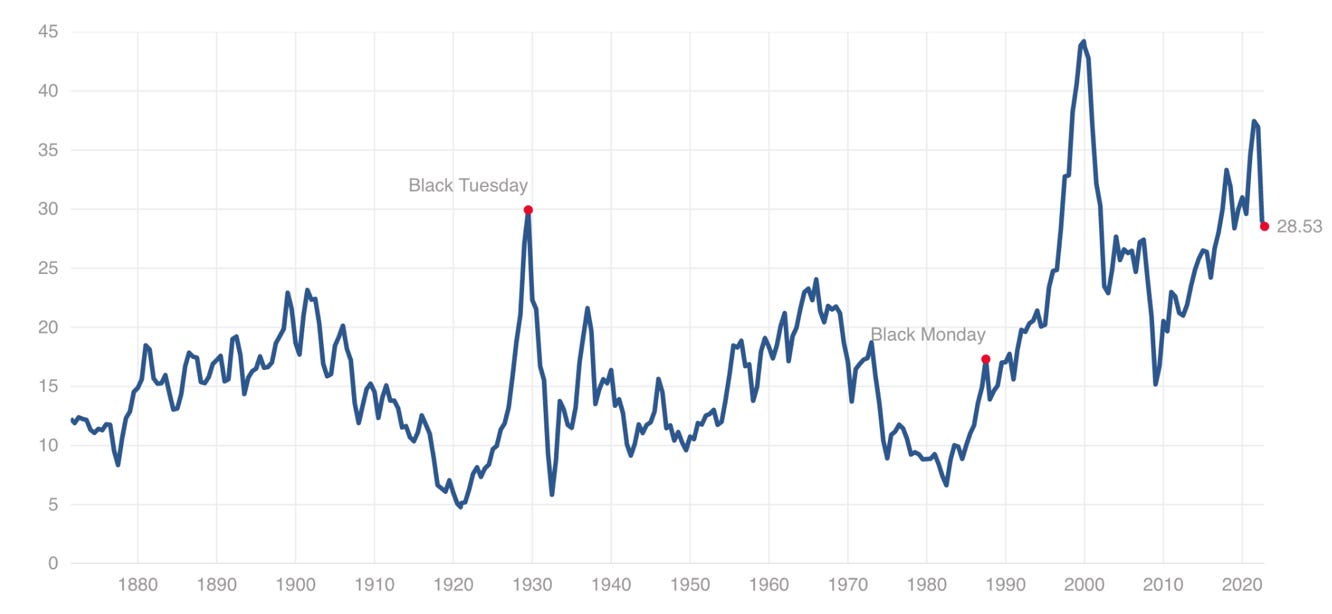

First, the valuations of both stocks and bonds: the two constituents of the standard 60/40 portfolio have exploded in the past 40 years. And even with this year’s pullback, they are in historically high ranges.

Here’s the Shiller P/E of the S&P 500, which is one of the go-to valuation metrics for longer time frames:

Bonds’ inflation-adjusted yields, although growing, are still historically low:

But low rates didn’t just turn 40% of traditional portfolios into bullcrap-yielding bonds.

Coupled with raising inflation, they made bonds highly correlated with stocks. That goes against the logic of the 60/40 portfolio where bond prices are supposed to move in the opposite direction and work as a counterweight for stocks:

In fact, 2022 was the first year in history when both stocks and bonds declined by double digits. And the 60/40 portfolio recorded its worst return on record:

This unfortunate setup coupled with technological advances has urged a boom in so-called “alternatives” as a way to diversify from the increasingly correlated and overvalued traditional portfolios.

That’s a fancy word for investing in any stuff other than bonds and stocks. It could be real estate, private companies, loans to people or businesses—or even a pair of collectible Jordans.

Take a look at how alternatives have hijacked the portfolios of global pension portfolios:

By 2025, alternative investments are expected to gobble up $17.2 trillion in capital—a 4x increase since 2010. And most of that capital will come from institutional investors and ultra-high-net-worth individuals (UHNWIS).

Last year, UHNWIS reported holding about half of their assets in alternatives. And if we single out just billionaires, that allocation would grow to a crazy 54%, according to KKR.

That’s right. The world’s richest people have parked over half their net worth into assets that the average investor has barely dipped their toes into.

So today I’ll dive deep into probably one of the most bragging-rights’ worth alternative investments out there, and not just because of its entertainment value. For the first time in history, this investment has opened up to the average investor—and it’s well worth looking into.

I’m talking about fine art.

Masterworks: Invest in “blue-chip” art like a billionaire

Masterworks is the world’s first company that “securitized” fine art and gave the average Joe access to multimillion-dollar artworks from the likes of Pablo Picasso, Claude Monet, and Leonardo Da Vinci (or what they call blue-chip art).

The company was founded in 2017 by a guy named Scott Lynn who has been a somewhat recognized art collector who realized art could be a much bigger asset class if more investors had access to it.

So he took advantage of “Regulation A,” which lets companies crowdfund SEC-qualified investments in private assets from real estate to venture capital—and now contemporary art.

I’m a bit of a data geek, so the most fascinating part of Masterworks’s platform is its price database. Its data scientists devoured 70 years’ worth of paper auction records and 60,000 data points to build the world’s first digital database of art sales.

This database serves two purposes.

Obviously, it lets them boil down otherwise scattered art sale records into an easily comprehensible annualized return that works as its biggest value proposition for attracting capital.

At the same time, it gives its team of analysts a lot of input to build quantitative models that allow Masterworks to bid on artworks that can deliver the best and most predictable returns.

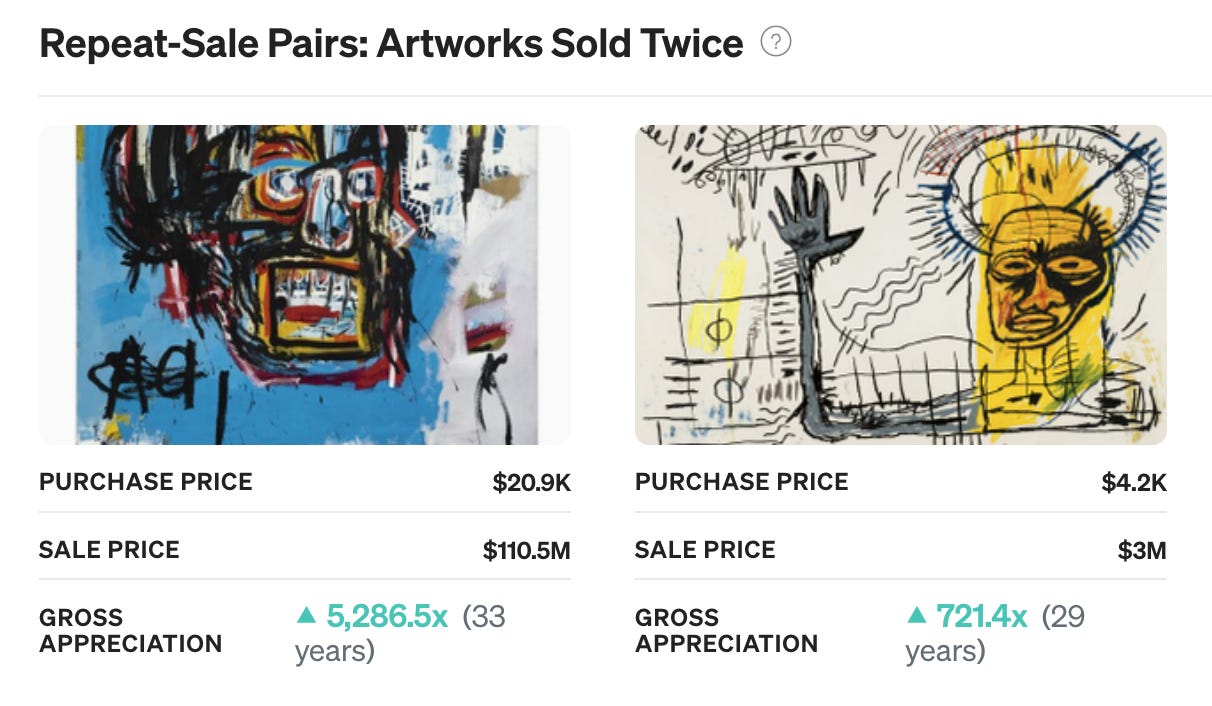

This is why they specifically focus on contemporary artwork that has been auctioned at least twice.

Post-war contemporary art has the most reliable data Masterworks can collect and tap into. And that data told them that if there’s one thing all best-performing artworks from this segment share is repeat sales.

So how does Masterworks “IPO” art exactly?

Masterworks’s research team will scout the market. And once they’ve found a piece of art they believe they can buy at a significant discount, they place a bid and file it with the SEC as a public offering.

Then they crowdfund it on the platform by securitizing the artwork into shares worth as little as $20.

The artwork is then held for an average of three to 10 years before being auctioned off.

If you have to realize the position before Masterworks decides to sell the artwork, there is the secondary market where you can sell your shares to other Masterworks users (although as you can imagine, it has limited liquidity.)

You can skip the waitlist and check the current offerings through this link.

But the question is… entertainment value aside, can Masterworks actually help you build a more diversified portfolio? What return can the average investor realistically expect? And does Masterworks have any track record in realizing any of its investments yet?

Let’s look at the data.

“Blue-chip” art as an asset class today

Shelling out a couple of million dollars for a painting may seem like a lavish act of display for the ultra-wealthy. But regardless of what you think of art and its fair value, hard numbers tell a whole different story.

Art is a growing asset class that’s worth $1.7 trillion today, and it takes quite a significant place in ultra-wealthy portfolios.

Take a look at this chart that shows how this asset class stacks up against other asset classes in terms of 1) overall capitalization, and 2) how much capital the ultra-wealthy have tied up in it:

(h/t to Not Boring)

The closest retail comparison I can think of would be gold, probably the most popular alternative store of value after real estate. Although it has a slightly negative anti-government/prepping connotation.

Masterworks’s data overstates the importance of gold because its data includes central bank reserves. Private investments in gold make up just $2.5 trillion, which means art is not far off from gold in terms of private market capitalization.

Which, honestly, is surprising for such a seemingly niche market.

What else surprised me is how much capital the ultra-wealthy parked in this asset class The world’s richest families hold nearly twice as much capital in the likes of Salvator Mundi than in gold.

And if you look into the characteristics of this asset class, there’s a lot of sense to that.

First returns

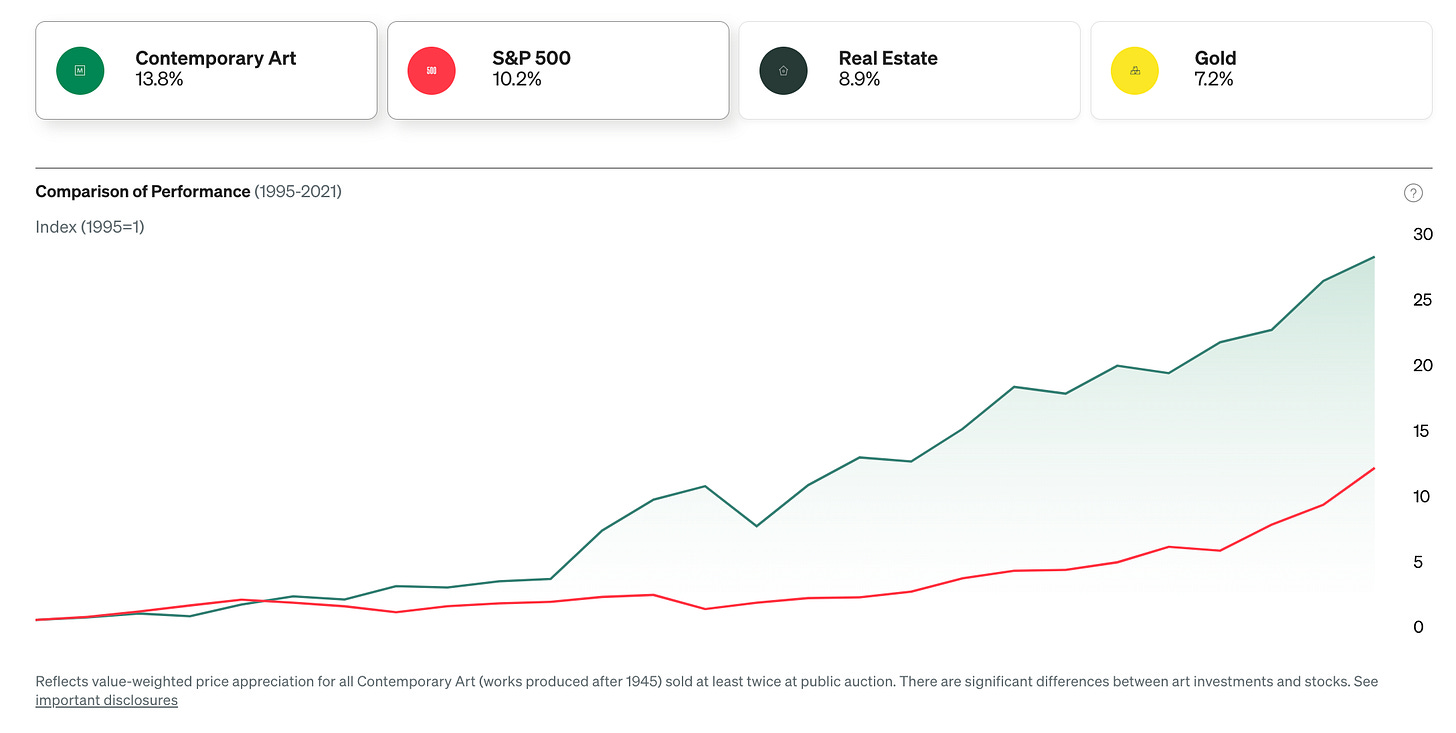

According to Masterworks’s data, over the past 25 years contemporary art has outperformed real estate, gold, and even the S&P 500 (with dividends), as you can see here:

In this timeframe, contemporary art has outperformed gold by 6x and the S&P 500 by nearly 2.5x.

Now, to be fair, there will always be some bias in data coming from a company that is incentivized to crunch it in a way that sells its value proposition best. So we have to look at it with a grain of salt.

And while Masterworks’s data isn’t inaccurate or misleading by any means, it’s glossing over a couple of important things art investors should know.

If you extend the timeframe to 35 years, the returns of contemporary art would drop almost in half to 7.5%, according to the latest art market report from Citi:

If you were extra nitpicky, you could say Masterworks’s stock vs art comparison isn’t apples to apples because contemporary art is just a small subset of the art market that’s just happened to show the best performance in the past 25 years or so.

By that logic, it would make sense to compare contemporary art to a subset of stocks that’s done best in that timeframe too, which would be the Nasdaq index. And in that case, stocks would outperform art.

In Masterworks’s defense, you could say it’s fair juxtaposing because they only focus on post-war contemporary art and the S&P 500 happens to be the most widely recognized benchmark of stock performance.

Finally, there’s a “survivor bias” in Masterworks’s data because it contains only blue chip art—that is, the most famous artworks that have been publicly auctioned off. But what about those that fell into oblivion and lost their value?

Again, in Masterworks’s defense, that’s what their platform is all about. They crowdfund not just any but specifically blue-chip art that has historically delivered the best and most consistent returns.

Diversification

But returns are just one piece of the puzzle.

Apart from being a bragging rights-worthy trophy for the rich, art also serves as an important investment objective: it’s an incredibly effective diversifier against traditional investments. And that’s where it shines best.

According to the last Citi report, art is among the least correlated investments with most asset classes. Take a look at the matrix below that shows art’s correlation coefficients with 10 other investments.

(Explanation: correlation coefficient measures assets’ “co-movement” with one another. It’s expressed on a scale of ‘-1’ to ‘1’ where ‘-1’ means that assets move in exactly opposite directions and ‘1’ means that assets move in perfect tandem.)

From a diversification standpoint, art behaved very much like gold, which also has a comparably low correlation with other asset classes. What’s interesting, though, is that gold and art don’t show much co-movement either.

Which means adding both to your portfolio could hedge it even more.

The caveat is that, like gold, art has shown a negative correlation with real interest rates. (That is, what you can earn from risk-free government bonds after inflation.) And as we know, the Fed is now pushing rates up real hard.

From Citi report:

Over time, art prices have tended to move more closely in line with changes in real interest rates, that is, interest rates after inflation. Periods of falling and/or low real interest rates have often coincided with rising art prices. This relationship is rooted in the nature of art as an investment. Art does not pay an income stream to its owners. Indeed, it has a slightly negative income stream, as owners have to pay for insurance, storage, transportation, and maintenance. When real interest rates are high or rising, the opportunity cost of owning art is higher. Owners are passing up the returns they might otherwise have earned on interest-bearing assets. However, this consideration fades as real rates fall, hence art’s often-stronger performance in such times.

That would be a worry if you were day trading Salvatori Mundis. But because artworks are typically held 3-10 years, and real rate growth is limited given how much debt the world carries, the rate risk is probably of little concern in the long run.

But that’s enough for theory. Let’s look at how Masterworks’s hand-picked artworks have actually performed.

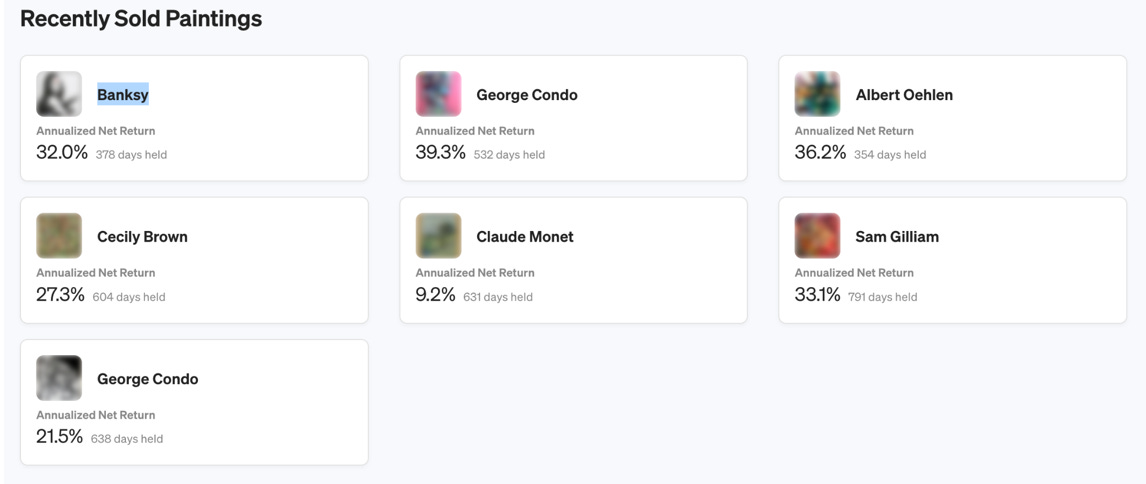

How much have Masterworks investors earned so far?

So far, Masterworks has realized seven artworks, and all at a considerable profit:

Banksy’s Mona Lisa sold on Oct 2019 for a 32% annualized gain

Goerge Condo’s Staring into Space sold on Dec 2021 for a 39.2% annualized gain

Albert Oehlen’s Doppelbild sold on Feb 2022 for a 33.8% annualized gain

Cecily Brown’s Lured sold on July 2022 for a 27.3% annualized gain.

Another piece by George Condo sold on October 2022 for a 21.5% annualized gain.

Sam Gilliam’s Tracing for a 33.1% annualized gain

Claude Monet's Coup de vent for a 9.2% annualized gain

(The percentages are expressed as IRR [internal rate of return], which is profit net of all costs and platform fees.)

Those seven masterpieces delivered an extraordinary return to investors who basically doubled their money in a few years. But of course, those are just a fraction of Masterworks’s portfolio that is yet to be realized.

Today Masterworks has a portfolio of 126 artworks. And we won’t know their actual market value until after they are sold. But you can get a little taste of where the portfolio is headed from the appraisal update for Q2 2022 (h/t to Joshua Heier):

And here’s a breakdown by winners and losers (as of Q2):

In all, from Sep 2019 to q2 2022, Masterworks’s portfolio saw an annualized appreciation rate of 15.3%

Not bad for a start.

But again, this “appreciation rate” doesn’t necessarily represent the actual market value of those assets. It’s what their in-house staff thinks they’re worth based on comparable artwork sales.

And as you’d expect, there may be a great variance in pinning down the value of a one-of-its-kind artwork.

Will blockchain explode blue-chip art?

This review wouldn’t be complete if I didn’t add a few words of caution:

Art is a truly high-risk investment that should be viewed as a supplement to traditional assets, not a replacement.

Those assets are extremely illiquid because it could take three to ten years for Masterworks to sell them. And the secondary market doesn’t have much volume, so you really need to be prepared to stay in for the long haul.

The platform has high fees compared to other types of investments.

On the other hand, Masterworks is the world’s first platform to have brought fractional ownership to “blue-chip” art. The concept is relatively new, which naturally comes with extra cost and risk.

But where there is risk there’s also opportunity.

What if the securitization of fine art is just the beginning?

If blockchain technology gets adopted at scale after the current cleanse, there’s a real chance that “analog” art could be tokenized. That would give this asset class more transparency as well as access, and could potentially drive up art prices.

In fact, Citi predicts:

“Specifically, digital technologies such as blockchain could help automate vital processes, including establishing authenticity and performing valuations, as well as enabling sharebased investment in individual works and collections. More transparent pricing, more readily available data on sales, greater market liquidity, and lower transaction costs could result. If realized, such efficiencies would make the art market more attractive for collectors and investors alike.”

Could a painting you buy today on Masterworks be sold through a blockchain a decade from now? It’s a long shot for sure, but considering all the recent advances in that domain, it’s not outside the realm of possibility.

With all that said, if you want to take your first step into alternatives or even just learn something new about art or collectibles as a whole, Masterworks is a great place to start—if for no other reason than having a solid conversation starter.

Skip the waiting list and browse masterpieces available for investment.