"Dramatic" HODLer Capitulation, Smart Money Comeback, Europe's Energy Crisis & More

In this week's issue, we dive into Glassnode's latest on-chain report that points to "dramatic" migration in bitcoin, the resurgence of smart money in the stock market, and top macro trends.

Good morning MIMs,

Before we dive into this week’s issue, remember that all recessions are backdated. If our economy is indeed in one, when the NBER formally declares it, we’ll likely be most of the way through it. For example, the 2008 recession, which technically started in December 2007, was only declared in December 2008 —six months before it was over.

What happens next? You’ve guessed it: a bull market! Historical data shows that stocks soar 9 out 10 times a year following the end of recessions:

Source: Darrow Wealth Management

📈 Stocks

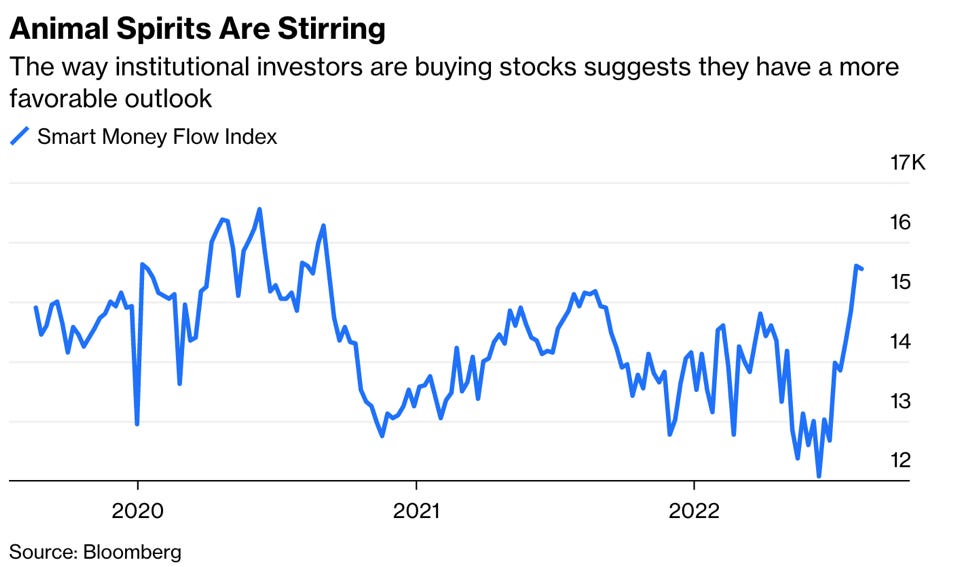

Smart Money is Piling Back into Stocks

Speaking of celebrating the end of a recession that hasn’t even been declared, smart money is already in on the act. Trading patterns signal that after the dormant first-half, big investors are backing up the truck again.

🔍 Zooming out

There isn’t a clear-cut way to read institutional flows in the sea of millions of trades, but there are a few indirect gauges.

One is Bloomberg's Smart Money Flow Index. It compares the first half hour of trading —driven by emotional trades and market orders—to the final hour, when big investors typically place their bets, in the Dow Jones Industrial Average.

Since mid-2021, the “smart money” index had fallen off the cliff. But after hitting its low in May when the S&P 500 tipped into a bear market, institutional buying quickly rebounded to the highest level in two years.

That’s a big about-face.

Just two months ago, institutional investors had the bleakest outlook in 30 years. Based on Bank of America’s June survey, 73% of fund managers who oversee nearly a trillion dollars in assets “were pessimistic about global growth”—the highest share since 1994.

Not only that, BofA predicted that the S&P 500 would bottom out at 3,000 in October, which is 31% lower than today's level: “History is no guide to future performance, but if it were, today’s bear market would end on October 19, 2022, with the S&P 500 at 3000,” its analysts wrote.

🔮 Looking ahead

That’s not to say stocks are out of the woods yet.

The Fed is nowhere near the end of this tightening cycle. Before scrapping forward guidance in June, Fed officials saw the rates closing out this year at 3.4% and the next at 3.8%.

📖Recommended read: a primer on reading the Fed’s dot plot

So there will clearly be more hikes down the line. Which, as we know, is bad for stock valuations. (If you missed it, 📖 recommended read: how rates affect stock valuations.)

Meanwhile, it’s not yet clear whether inflation has really peaked

And even if it has, economists think that the hardest part won’t be taming it but bringing it back to the Fed’s “neutral” rate at ~2.5% in the backdrop of inflationary forces, such as Europe’s looming energy crisis and broader de-globalization.

In the end, the Fed may have to resort to much more tightening than the market has priced in.

🚀 Digital Assets

Bitcoin’s “Dramatic” HODLer Capitulation Foreshadows a Bull Market

In the latest on-chain report, Glassnode calls a “dramatic” change in bitcoin ownership structure, with hundreds of thousands of bitcoins changing hands from long-term bitcoin holders to new investors.

“After a dramatic capitulation event, the ownership structure of bitcoin has been reshaped. As markets sell-off, bitcoin migrates from weaker hands to those stepping in at the lows,” Glassnode tweeted.

Such migration, as their analysis shows, is the canary in the coal mine that often tips off the beginning of a structural bull market.

🔍 Zooming out

There are two important on-chain metrics and, probably even more important, the discrepancy between them that gives us some insight into who’s been the biggest bitcoin sellers lately.

The first is “Long-Term Holder Cost Basis” (LTH-Cost Basis). It estimates the average price at which long-term bitcoin holders bought their coins. As of mid-July, LTH Cost Basis was $22,300, which means that even at today’s prices, the average long-term bitcoin holder is still up.

The second is “Long-Term Holder Spent Output Profit Ratio” (LTH-SOPR), which shows how much profit or loss long-term holders realized after actually selling their coins. According to Glassnode, in July, bitcoin long-term holders were realizing an average -33% loss.

This discrepancy between LTH-Cost Basis and LTH-SOPR tells us that the biggest sellers in this year’s rout were the ones that bought in close to the top and bore some of the biggest losses.

And to whom did they sell? Short term holders.

According to Glassnode data, since the Luna collapse in May, short-term holders have snapped up 330,000 bitcoins at or below $20,000, which puts them in an “advantageous financial position.”

So, what is essentially happening is that bitcoins are migrating from those who bought in at the highs and are most price-sensitive to those who bought bitcoin at the recent lows and are less price-sensitive.

Which is a dynamic that historically marked bottoms in bitcoin.

As Glassnode wrote in a previous note: “For a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and with the highest conviction.”

🔮 Looking ahead

That said, much of the conviction that brought new bitcoin investors largely hinges on a flurry of positive news.

For one, July’s better-than-expected inflation rate put investors back in high spirits, boosting most risk assets. Since mid-July, the S&P 500 and Nasdaq have rallied more or less in line with bitcoin.

Bitcoin, for its part, also scored two massive institutional wins.

Earlier this year, Fidelity added bitcoin as an option to its 401k plans and BlackRock is joining up with Coinbase to bring bitcoin to its “Aladdin” institutional clients who manage over $21 trillion in assets.

Meanwhile, lawmakers in the U.S. and EU are hammering out sweeping crypto legislations that will subject crypto to traditional-asset regulations, which could finally legitimize bitcoin in many institutional portfolios.

So, if these developments don’t change their course, bitcoin may be in for a strong comeback. On the other hand, with so much hope priced in, there’s a lot that can go wrong.

🏛️ Macro

Here’s a quick run-through of the most important macro developments across the globe:

US consumer sentiment jumps to a three-month high on the back of easing inflation worries—blowing away most estimates. Still, at 55.1, the University of Michigan’s index is the worst in 40 years. 🙋 Explainer: the index is one of the key economic indicators because consumers drive as much as 70% of US GDP, so their attitudes go a long way in gauging where the economy is in the cycle.

Elsewhere, for the first time in over 40 years, the UK is witnessing double-digit inflation. In July, its CPI rose to 10.1% year-over-year, thanks, for the most part, to rising food prices. The Bank of England thinks it’s not the end and predicts inflation topping at 13% in October.

Meanwhile, the end of the hot, energy-light summer makes Germany’s blood run cold. Its energy regulator warns that even if the country tops up its natural gas reserves to 95%, the country won’t last through the winter without Nord Stream. According to Goldman Sach’s energy analysts, in the worst-case scenario, “industries like chemicals and cement in Germany… might have to cut their gas usage by as much as 80%.” And get this, “We estimate it could mean a 65% industry curtailment in Germany if flows stopped coming entirely.” All this could stoke global inflation and bring another bout of supply chain disruptions. 🙋 Explainer: Natural gas is Europe’s second biggest source of energy, a lot of which comes from Nord Stream. The pipeline is owned by Gazprom, a Kremlin-controlled gas giant that Putin uses as leverage to blackmail Europe into lifting sanctions.

💬 Quote MIMs are pondering

“Though tempting, trying to time the market is a loser’s game. $10,000 continuously invested in the market over the past 20 years grew to more than $48,000. If you missed just the best 30 days, your investment was reduced to $9,900.”

— Christopher Davis, Portfolio Manager at Davis Advisors

🤔 Takeaway: stay invested and dollar cost average. It only takes a handful of misses over the decades to ruin your long-term gains.