Bonds Are King

In this week's MIM, we delve into crypto's decorrelation from stocks, real yields and their devastating toll on stocks, and the investment implications of Russia's first mobilization from WWII...

Morning MIMs,

Before we dive into today’s issue, remember that stock prices don’t reflect the present. They are a function of the consensus expectation of what the future holds. So just because the worst hasn’t yet come, it doesn’t mean it isn't priced in forward-looking stock prices. As Howard Marks wrote in its last commentary:

“Since future conditions (as opposed to present conditions) may already be incorporated in prices, a poor macro outlook isn’t necessarily synonymous with prices declining, and a good macro outlook needn’t be synonymous with prices rising. Investors should be wary of sweeping generalizations about whether it’s time to buy or sell."

📉 Stocks

Bond. Investment-Grade Bond

As the bleed-out in stocks continues, the bearish mood sweeps Wall Street.

Last week, Morgan Stanley reiterated their earnings recession call. They predict stocks are in for another haircut because the market overshot with earnings projections. And then there’s an issue of rising real yields.

Real yields are also the reason Goldman Sachs trimmed their year-end forecast for the S&P 500 from 4,300 to 3,600 and called equities “underweight.” Meanwhile, Blackrock went as far as to advise its clients to “shun most stocks.”

Why are real yields so important that they scared most of Wall Street into the fetal position?

From “TINA” to “TARA”

There are two main asset classes that fight for a place in each portfolio: stocks and bonds.

As a rule, bonds are a safer investment that gives investors a steady income with a relatively low risk. The catch is that investment-grade bonds pay out little and don’t always protect from inflation.

Stocks earn more, but at a risk. Their income is not guaranteed, and stock prices can be very unstable. That’s why investors ask for a higher return from stocks as compensation for taking that risk.

This is the reason the price investors are willing to pay for stocks depends not only on where they are in terms of their historical valuations, but also on how they stack up to valuations of other asset classes, especially bonds.

But look what happened during Covid.

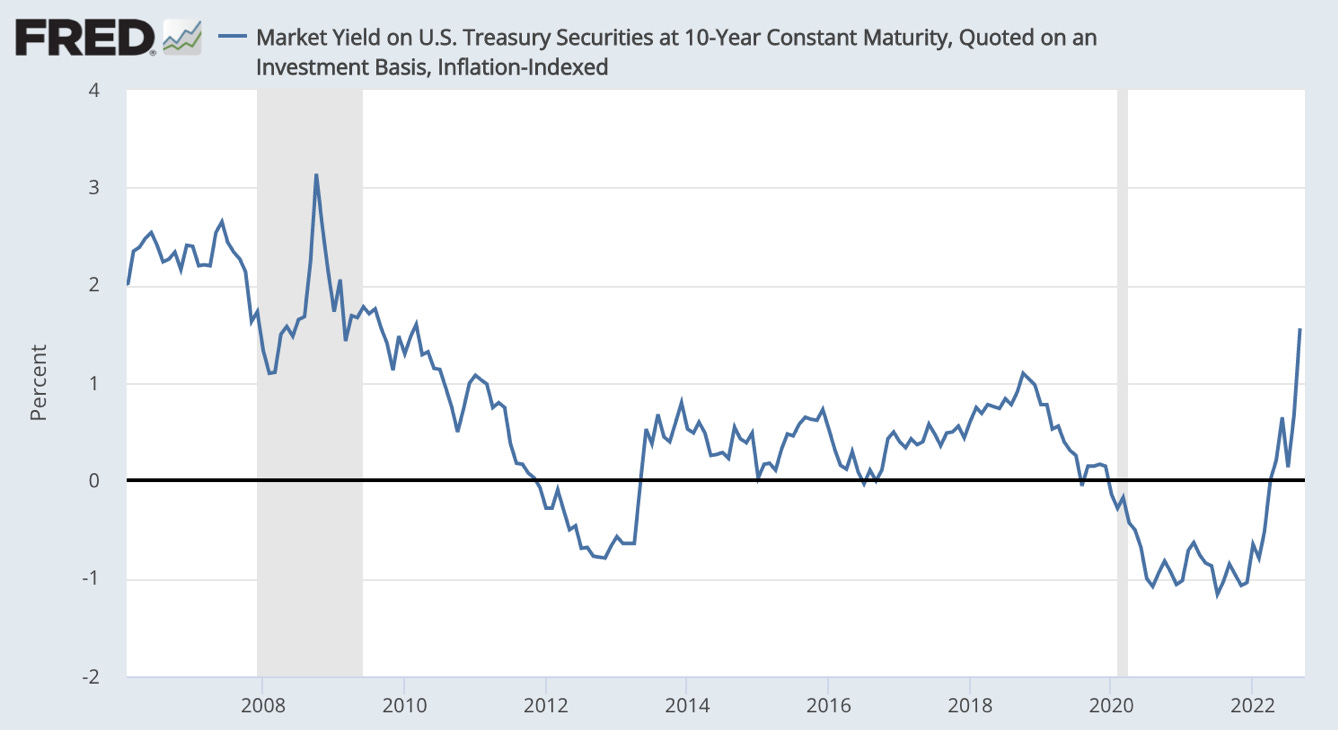

After Covid swept the world, the Fed slashed interest rates to zero, which in turn pushed down bond yields. For example, the real yield on the world’s most popular bond-10-year Treasuries—fell into negative territory.

And while inflation has been picking up since the beginning of 2021, the Fed sat on its hands until very recently.

All this kept real yields in the red, which meant bond investors were essentially losing money. So they were left with no other option than to invest in overvalued equities to protect themselves from rising inflation.

Goldman Sachs dubbed this period TINA, or “there is no alternative.”

But now the tide has turned.

Earlier this year, the Fed launched the fastest tightening program since the 1980s. In his quest to tame inflation, Powell pulled five hikes bringing rates from near zero up to 3.25% in just a little over half a year.

And for the first time since the beginning of 2020, real yields made into positive territory. In fact, they are now at the highest level since 2008:

This is not the end.

The Fed’s median forecast shows that it expects to hike all the way to 4.6% in 2023. That’s still a long way to go, and a lot of room for real yields to rise, which doesn’t bode well for valuations.

See how real yields correlate to the S&P 500’s forward P/E (chart on the left):

Goldman Sachs calls this turn of events TARA. “Investors are now facing TARA (There Are Reasonable Alternatives) with bonds appearing more attractive,” its analyst wrote in a recent note.

Looking ahead

As investment-grade bonds begin generating real income after years of negative returns, the market comes back to normalcy where investors have options to swap out overvalued equities with safer fixed income.

Will stocks manage to grow their earnings as much as to make up for the loss of their allure against growing bond income? Or contrarily, will we see a Morgan Stanley-predicted earnings recession, which will make stocks even less attractive?

Keep an eye on things like real yields and earnings yield to keep your finger on the market pulse.

🚀 Digital Assets

Is Crypto Breaking Up with Stocks?

Crypto is lately behaving in a way that it hasn’t for a long time.

In the past week, all major stock benchmarks were deep in the red. The S&P 500 cratered to 3,600 and hit the lowest level since Dec 2020. And both the Nasdaq and Dow were down some 5%.

Meanwhile, crypto has unexpectedly lunged in the opposite direction. In the same span, bitcoin jumped 6%, ethereum is up 4%, and many major altcoins scored near double-digit gains.

This decoupling came as a big surprise because for much of 2022 crypto moved in tandem with stocks.

As we wrote back in April:

“Major cryptos are highly correlated to the stock market. They also have a high beta to stocks. That means crypto, in effect, amplifies stock moves. If stocks soar, cryptos soar higher. And vice versa. If stocks tumble, crypto goes into free fall. Not only that, both the correlation and beta have significantly increased since the beginning of the pandemic, according to the IMF.”

And until very recently, this correlation held at record highs:

So, is the long-awaited crypto decorrelation here? Or is there something else at play?

Zooming out

The answer is yes and no.

There are two theories that explain crypto resilience in the face of market turmoil. The first is that crypto has gained a critical mass of long-term investors (aka HODLers) who have enough conviction to hold through the crash.

In a recent note, Bitnex wrote that their data shows the “anomalous” rise of bitcoin HODLers despite the bear market: “The number of HODLers in the top 5 categories (up to 0.1 BTC) has grown under bearish market conditions since April 2022, which is anomalous to previous bear market data. This is even more testament to retail investors and crypto adoption growing even when the macro conditions face headwinds.”

Glassnode’s on-chain analysis confirms that HODLing is at record levels and has a profound effect on bitcoin prices: “The cohort of investors with older coins remain steadfast, refusing to spend and exit their position at any meaningful scale… with mature spending severely muted, the degree of HODLing behavior is historically high.”

The other theory is that this brief decorrelation is just short-term noise because crypto was simply faster to digest macro news and corrected in full before the stock market.

“[The Fed] was heavily front run in crypto, and we’re hence seeing a correction before stocks have even fully moved,” Wilfred Daye of Securitize Capital told Bloomberg. “This has been a pattern we’ve seen repeatedly with event-driven moves recently due to the relative immaturity of crypto markets and their participants.”

Looking ahead

With just a few weeks into decoupling, it’s too early to call a full-fledged crypto “decorrelation” from stocks. On the other hand, as far as bitcoin is concerned, HODLer conviction alone is giving hope that further downside is limited.

🏛️ Macro

Russia’s First Mobilization Since WWII

After shameful defeats in Eastern Ukraine, last week Russia’s president Vladimir Putin did something that has never been done since WWII. He ordered a mobilization of up to 1.2 million troops to fight in Ukraine.

Since the beginning of the war, Russia’s propaganda machine framed it as a low-key “special military operation.” And with its army made up of mercenaries from Russia and its allies, including Syria, the war hasn't affected Russians that much.

But the draft is bringing Russians down to earth.

In and of itself, this act is a formal declaration of war that shatters the “special military operation” narrative to pieces. It’s also a wake-up call for millions of citizens that the war is coming to their homes.

And that they may be sent to die in the name of Putin’s imperialistic compulsions.

Zooming out

What can we make of Putin’s move?

Knowing that Russia hides a lot of information from its own public, it’s hard to tell the real scale of this mobilization. And we’ve seen a ton of leaked information that contradicts the Russian government’s claims.

For example, Russia’s defense minister, Sergei Shoigu, says that this partial mobilization will deploy up to 300,000 troops. But Russian independent news outlets, including Novaya Gaeta and Meduza, reported that the mobilization act empowers Putin to draft up to 1.2 million reservists.

Another question is how effective this draft will be.

The mobilization is widely unpopular with Russians. There are a dozen reported arson attacks on enlisting officers as well as protests across the country. While the Kremlin can lock up thousands of protesters, can it compel hundreds of thousands to fight against their will?

Even if this mobilization succeeds in calling up enough soldiers, how effective will they be at the front? A conscripted civilian does not necessarily make a good soldier. In fact, some draftees reported on Telegram that Russia will send them to the front after just a week of training, if any.

That’s on top of being holed up in non-humanitarian conditions because Russia doesn't have the infrastructure to accommodate that many conscripts at such short notice. Some “barracks” don’t even have beds and running water.

There are also reports that draftees are asked to bring their own supplies, including med kits and sleeping bags, and are being assigned WWII-old rusty rifles.

How’s that for keeping up soldier morale?

It’s hard to believe that soldiers who were unwilling to fight in the first palace, and then put through all this, will manage to break through Ukrainian defenses hinging on high morale and modern Western weaponry.

What does it mean for investors?

If anything, Putin’s draft is more of an act of desperation than a strategic move that can yield anything meaningful. And unless Putin resorts to the unthinkable (i.e. nuclear strikes), this cannon fodder of a Russian army probably won’t do much.

That said, Russia’s risky move sends a clear message to the West. It signals that Putin is willing to go all in on this war because it may be his only way to hold up the regime. And a rumored concession is unlikely.

Which means inflation driven by the energy crisis is here to stay. And that’s going to be a big drag on the economy and, in turn, risk assets in the coming year.